AllianceBlock Fundrs aims to take the best elements from venture capital, blockchain, and social media and combine them to create a more effective, 21st-century model to fund promising startups.

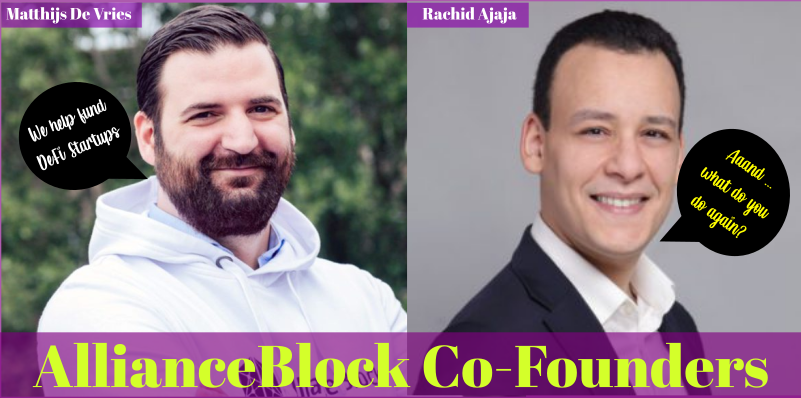

Co-founder and CTO Matthijs De Vries began his career in software development, working across different industries before joining a management team. He then moved on to a small AI company in the blockchain realm.

As a product lead, De Vries was continually looking at new technologies, and while he had been aware of blockchain, he paid little attention. Then Ethereum debuted, and it changed everything for him. De Vries began participating in Twitter and Telegram discussions and investing in ICOs. He paid attention to successes and failures and often imagined how he would improve those early systems.

Why DeFi Funding Can Be Problematic

During this period, De Vries met Rachid Ajaja, and the duo would go on to find found AllianceBlock.

The pair began speaking on Telegram and soon met in person to discuss the many issues they saw with the funding patterns in the early ICO days.

And those issues were legion, beginning with easy money flowing into the space. Combine that with a lack of transparency, and all people needed to access millions were a white paper and some promotional skills. Where’s the motivation to develop a required product when you can raise millions within hours? How does one separate scams from legitimate projects?

Those discussions formed the basis of AllianceBlock Fundrs, which brings together startups with backers who are knowledgeable and committed to building a vibrant ecosystem.

“If you think about it, you have these promising startups, but they have absolutely no guidance,” De Vries said. “And they have simply the wrong tools to raise money because it’s too easy to raise money.

“If you build a startup, you want to reach a goal such as becoming a unicorn or gradually increasing your startup’s value. Of course, everyone raves over an overnight success getting all this money immediately, but it’s not how it works. You chase this light at the end of the tunnel. This keeps you focused and motivated to go forward and keep delivering.”

If opportunists see a good chance for fast money, they’ll flock to it. Yes, they will be joined by some genuine problem solvers, but how does the investing public know the difference, especially in a such a new space?

How AllianceBlock Fundrs Resolves These Challenges

The answer begins where it started for De Vries, and that is in communities of people interested in the potential of DeFi. He and Ajaja sought to leverage the power of Telegram, Twitter, and Reddit communities and include them in the funding process while developing a milestone-based funding process that rewarded entrepreneurs for progress, not self-promotion.

During AllianceBlock’s incubation period, De Vries and Ajaja learned the importance of compliance, which he said many preached but few addressed. They needed to meet compliance but in such a way as to not alienate decentralized communities.

“We needed to find a compromise with decentralized-focused communities, where you have a different way of looking at how you share your identity with someone,” De Vries said. “How do you perform this KYC verification?”

Additional issues De Vries and Ajaja sought to tackle were the cost and repetitiveness of identity verification.

At maybe $15 per check, it was costly for a startup. And with a person having to repeatedly share sensitive information every time they engaged with a new company, it was also needlessly time-consuming and risky.

Privacy and ID Verification Must Be Balanced

AllianceBlock’s search took them to identity verification company GBG, where they developed a verification solution that allowed individuals to maintain their privacy.

“We wanted to address this and make it so that you can make sure that someone is verified without knowing who this person is,” De Vries said. “You could interact on our platform Fundrs, for example. You could have connected the KYC verification to your wallet.

“And we can be certain because of the information that we get, it’s all anonymous information, that you are verified, whitelisted, and you’re not at the sanction list. But we still have no idea whom we are dealing with it. Why do we have to know? We don’t have to; we only want to know that it’s okay to deal with you.”

AllianceBlock Uses Group Reputation Management To Vet Upcoming Projects

Venture capital in DeFi is an exciting process, as its novelty means there is little industry expertise to vet projects. That was illustrated in the early days when money was thrown at companies that only had a whitepaper as output.

Many of the most knowledgeable sources were found on the internet forums, people with professional backgrounds in tech and marketing who were intrigued by DeFi’s potential. It was not solely about profit but also about building better systems for them collectively.

Even then, you had to be able to separate actual knowledge from hot air. AllianceBlock Fundrs developed a reputation-based system where community members build theirs by contributing in forums and sharing quality advice.

“This creates a more fair ecosystem where people who work together and add value to the community get rewarded, not in a monetary way, but the reputation,” De Vries said.

Identify true believers, give all an equal voice, and reward founders for their work and not just promise. That’s the AllanceBlock Fundrs recipe for success.

“A system that ensures that fundraising is more transparent and fair to the investor and the project itself….” De Vries said.“ The reputation-based system is a way to validate their ID in a vast audience. It gives you the tool to keep on refining what you’re working on.

“Working as a crypto startup, amongst a sea of people, can be a very lonely experience to find out if you’re on the right path. Here you have a more focused platform, where you can have honest feedback from the users because they want to participate in helping you make the best of yourself and other projects.”

How it works

Companies who participate with AllianceBlock Fundrs decide what percentage of their project will be offered on the platform, with funders able to mint an NFT representing their investment. That NFT can be redeemed for their portion of the project.

Funders can redeem their investment tokens or lock them with NFTs for the rALBT governance token. The Fundrs DAO votes on the worthiness of the project. If it passes, potential funders are invited to declare their intent to invest by purchasing Lottery or Immediate Funding Ticket allocations.

The on-chain lottery attempts to keep a fair system by introducing an element of luck. Funders could win several tickets based on tier access and reputation, which rewards them with chances to participate. The odds are influenced by the number of ALBT tokens staked and rALBT (reputation tokens) earned on the network.

When a funder submits an investment bid, those assets are locked in escrow if the token already exists. If not, a token generation event will occur, and the token will be locked in escrow.

Funders who win the lottery receive a minted NFT, representing the invested amount. That NFT provides eligibility to claim investment payments following the round. During the round, funders can lock those NFTs to obtain additional rewards.

Funders can redeem the NFTs for project tokens or tokenized share certificates at the end of the round. When lending occurs, funding NFTs can be exchanged for discounted project tokens.

AllianceBlock Fundrs DAO Set To Take Over Protocol Management

AllianceBlock Fundrs is developing a DAO (decentralized autonomous organization) that will eventually take over the protocol’s management.

The interactions of the DAO are automatically regulated by audited open-source code and smart contracts. It is organized in stages that transition automatically after a series of conditions have been met.